Data-Driven Decision Making in Financial Services: The VENDOR iQ Approach

In today’s rapidly evolving financial services industry, data-driven decision making (DDDM) is more critical than ever. As financial institutions face increasing pressure to optimise operations, mitigate risks, and adhere to stringent regulatory standards, leveraging data is no longer optional—it’s essential. VENDOR iQ stands at the forefront of this transformation, offering financial institutions the tools and insights needed to make informed, data-driven decisions that drive success.

What is Data-Driven Decision Making?

Data-driven decision making involves using data, rather than intuition or guesswork, to guide business decisions. By analysing key performance indicators (KPIs), trends, and patterns within the data, organisations can make more informed decisions that align with their strategic goals. For financial services, this approach is particularly valuable in managing risks, enhancing customer experiences, and staying compliant with regulations. According to the Harvard Business Review, businesses that embrace data-driven strategies are more likely to achieve significant improvements in their decision-making processes.

Why Data-Driven Decision Making Matters in Financial Services

The financial services sector is inherently data-rich, with vast amounts of information generated daily. However, the challenge lies in transforming this data into actionable insights. VENDOR iQ helps institutions overcome this challenge by providing a platform that aggregates, analyses, and visualises data in real-time, enabling leaders to make decisions based on accurate and up-to-date information.

1. Mitigating Risks with Data Insights

Financial institutions face numerous risks, from cyber threats to market volatility. Through data-driven decision making, VENDOR iQ empowers institutions to identify potential risks early, enabling proactive management. By continuously monitoring third-party relationships and supply chains, institutions can reduce their exposure to risks and respond quickly to emerging threats. Staying compliant with regulations, such as those outlined by the Financial Conduct Authority (FCA) and the Basel Committee on Banking Supervision, is crucial for mitigating these risks.

2. Enhancing Operational Efficiency

Operational efficiency is a key driver of success in financial services. VENDOR iQ’s data-centric approach helps institutions streamline their operations by identifying inefficiencies and areas for improvement. Whether it’s optimising supply chains or improving internal processes, data-driven decisions lead to more efficient and effective operations.

3. Ensuring Compliance and Regulatory Adherence

Compliance with regulatory standards is non-negotiable in financial services. VENDOR iQ assists institutions in maintaining compliance by providing real-time insights into their operations. By monitoring data for compliance-related issues, institutions can address potential problems before they escalate, ensuring they remain in good standing with regulators.

The VENDOR iQ Platform: Enabling Data-Driven Decisions

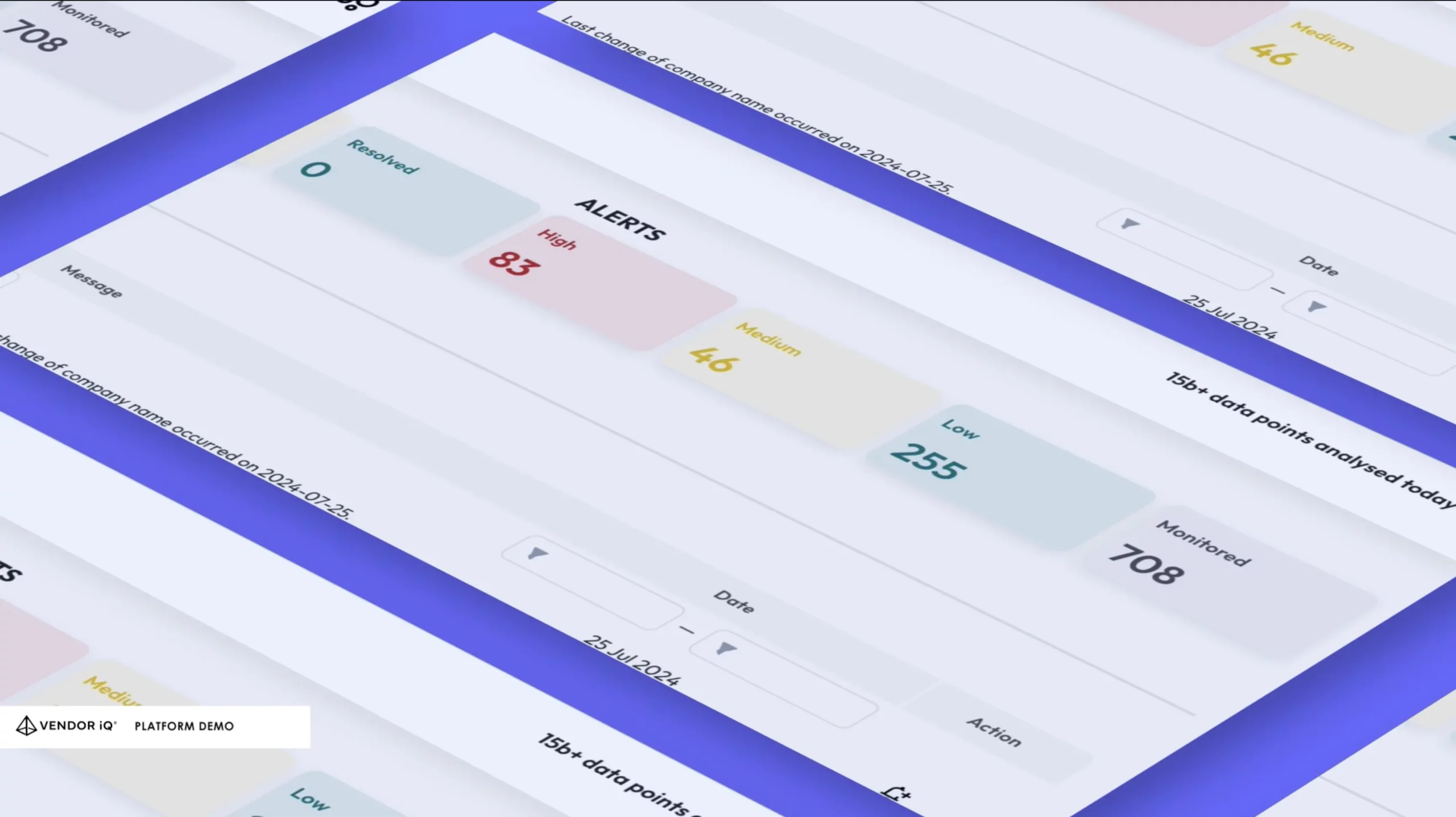

VENDOR iQ’s platform is designed to make data-driven decision making accessible and impactful. The platform aggregates data from multiple sources, providing a comprehensive view of an institution’s operations. With powerful analytics and visualisation tools, users can easily identify trends, monitor KPIs, and gain insights that inform their decision-making processes.

- Real-Time Data Monitoring: Stay informed with instant updates on key metrics and potential risks.

- Comprehensive Analytics: Dive deep into the data to uncover hidden opportunities and make informed strategic decisions.

- Customisable Dashboards: Tailor the platform to meet your institution’s unique needs, ensuring that the most relevant data is always at your fingertips.

Implementing Data-Driven Decision Making with VENDOR iQ

Transitioning to a data-driven approach requires more than just technology; it requires a shift in mindset. VENDOR iQ not only provides the tools needed for this transition but also supports institutions in developing a data-driven culture. By integrating data analysis into everyday decision-making processes, institutions can improve their agility, respond faster to market changes, and make more confident decisions.

Data-driven decision making is no longer a luxury for financial services—it’s a necessity. With VENDOR iQ, institutions can harness the power of data to drive operational excellence, mitigate risks, and ensure compliance. As the financial landscape continues to evolve, those who embrace data-driven decision making will be best positioned to succeed.

Are you ready to take your decision-making process to the next level? Discover how VENDOR iQ can transform your institution through data-driven insights and strategic decision-making tools.