Operational resilience in financial services has never been more critical

With insights from industry experts Wayne Green, Executive Advisor at VENDOR iQ, and Antony Bream, Head of Growth at VENDOR iQ, this article explores the challenges faced by financial institutions. By posing critical questions and highlighting innovative solutions, we delve into how VENDOR iQ can help navigate this intricate terrain.

Recognising the Challenges

Imagine you’re a compliance officer at a leading financial institution. Your daily responsibilities involve managing a web of suppliers, each critical to your operations. Suddenly, you receive news of a regulatory change – the Digital Operational Resilience Act (DORA) is coming into effect next year. What does this mean for your organisation?

DORA is just one of many regulations emphasising the need for enhanced oversight and resilience. With the FCA’s Consumer Duty Act and stringent AML requirements also in play, the question arises: How prepared is your organisation to meet these new demands?

Financial services firms often grapple with several key challenges:

- Supply Chain Complexity: Are you aware of the potential risks lurking within your supply chain?

- Regulatory Compliance: How equipped are you to comply with multiple, overlapping regulations?

- Operational Efficiency: Is your organisation spending more on managing compliance than it should?

Strengthening Provider Relationships

One of the critical aspects of operational resilience is strengthening relationships with your suppliers. But how can you engage effectively with your suppliers beyond the basics of contract and SLA management?

Wayne Green (WG), Executive Advisor at VENDOR iQ, shares his insights:

“We see a lot of focus now on companies having to restrengthen their provider relations. This challenge goes beyond contracts; it’s about having meaningful, factual conversations based on solid data.”

To tackle this, VENDOR iQ offers a platform that provides the necessary data and insights. This empowers your team to engage in informed discussions with suppliers, ensuring they meet resilience and risk management standards. Have you ever wondered how you can move from reactive to proactive supplier management?

Enhancing Operational Resilience

Operational resilience is not just a buzzword; it’s a necessity. In an era where cyber threats and fraudsters are increasingly sophisticated, how can your organisation stay one step ahead?

VENDOR iQ addresses this by enhancing visibility and preparedness. Antony Bream (AB), Head of Growth at VENDOR iQ, elaborates:

“There’s a huge focus on resilience now. Companies are asking us, ‘What do we need to be better at? How do we enhance our operational resilience?’”

By leveraging VENDOR iQ’s platform, you gain access to real-time data and insights that help you identify and mitigate risks before they become significant issues. This proactive approach ensures your operations remain robust and secure.

Optimising Operational Efficiency

Managing compliance and supply chains is costly and time-consuming. How can financial institutions optimise these processes to save both time and money?

VENDOR iQ offers tools that streamline supply management and governance:

- Contract Review: Are your insolvency clauses strong enough? Do they instil confidence?

- Contingency Planning: Do you have plans in place if a critical supplier fails?

Wayne Green explains:

“Optimising operational efficiency across the entire company is critical. VENDOR iQ helps reduce the time and cost involved in managing contracts and ensuring compliance.”

Mitigating Consumer Harm

With the FCA’s Consumer Duty Act in focus, financial institutions must ensure transparency and fairness. How can your organisation protect consumers and mitigate potential harm?

VENDOR iQ’s platform provides the oversight needed to ensure compliance with consumer protection regulations. This includes monitoring supplier performance and ensuring that services provided to consumers are transparent and fair. Are you confident that your current processes adequately protect your consumers?

A Data-Driven Approach

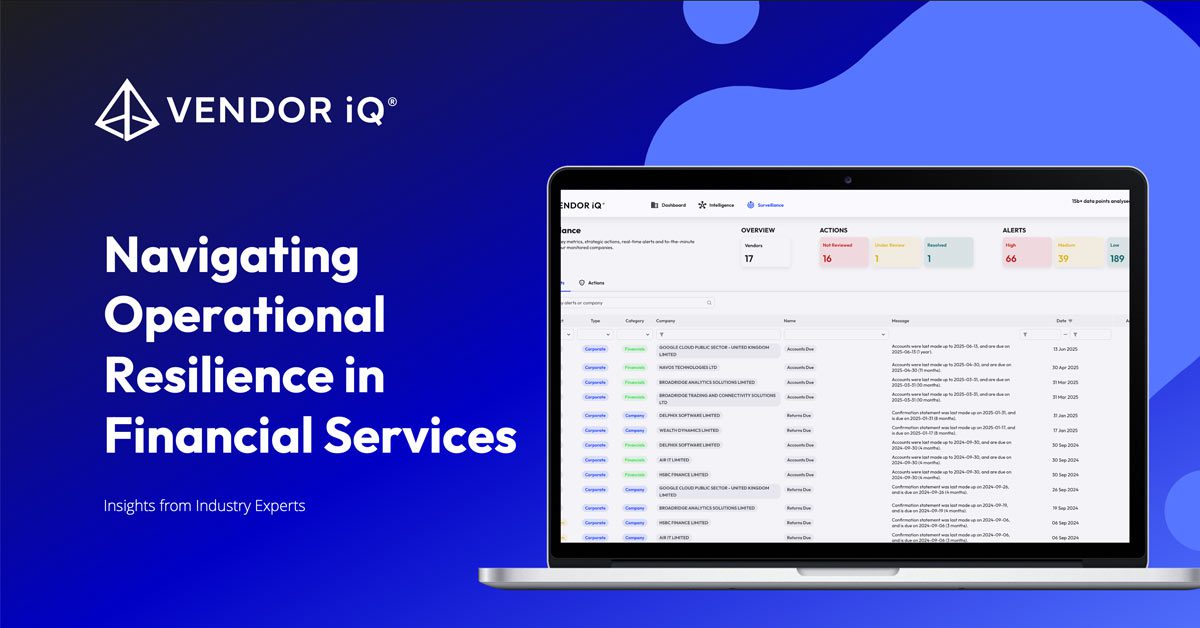

At the heart of VENDOR iQ’s solution is a data-driven approach that enhances risk management and operational resilience. By analysing extensive data points, financial institutions can make informed decisions and ensure compliance.

Key Data Points Include:

- Liquidity of Partners: Assess financial stability.

- Staff Turnover: Monitor turnover rates of key positions.

- Corporate Activity: Track mergers and acquisitions.

- Complex Ownership: Evaluate ownership structures for compliance.

- Regulatory Disciplinaries: Identify disciplinary actions against partners.

Antony Bream poses a critical question:

“How can we extract better value from our supplier relationships? We estimate about £3.5 billion a year is left on the table through lack of value extraction.”

Embracing the Future with VENDOR iQ

Reflect on the questions posed and the challenges highlighted. How prepared is your organisation to enhance operational resilience and optimise supply chain management?

VENDOR iQ stands ready to assist, offering innovative solutions that transform how financial institutions manage compliance, risk, and supplier relationships. By leveraging VENDOR iQ’s platform, you can navigate the complexities of the financial services landscape, ensuring your organisation is resilient, compliant, and poised for success.

Are you ready to take the next step in your operational resilience journey with VENDOR iQ?