Proactive Risk Management: Strategies to Mitigate Risks and Enhance Decision-Making

In an increasingly complex and fast-paced world, the ability to anticipate and mitigate risks is crucial for the survival and success of any organisation. Proactive risk management is an approach that not only identifies potential threats before they occur but also implements strategies to manage those risks effectively. This forward-thinking method helps organisations build resilience, protect their assets, and make informed decisions in an uncertain environment.

Proactive Risk Management Explained

Proactive risk management is a systematic approach that focuses on anticipating potential risks and taking preemptive actions to mitigate or prevent them. Unlike reactive risk management, which deals with risks after they have materialised, proactive risk management aims to prevent problems before they arise. This approach enables organisations to stay ahead of potential challenges and maintain a stable operational environment.

Why Proactive Risk Management is Important

Early Risk Identification:

By identifying risks early, organisations can address them before they escalate into larger issues. Early detection allows for timely intervention, reducing the likelihood of severe disruptions and ensuring that the organisation remains on track to achieve its objectives.

Informed Decision-Making:

Proactive risk management provides critical insights that inform decision-making processes. With a clear understanding of potential risks, organisations can make strategic choices that align with their long-term goals, improving overall performance and competitiveness.

Enhanced Organisational Resilience:

Organisations that practice proactive risk management are better equipped to withstand unexpected events. By preparing for potential threats, they can maintain continuity in their operations, even in the face of significant challenges. This resilience is key to sustaining long-term growth and success.

Key Strategies for Effective Proactive Risk Management

To effectively manage risks, organisations must adopt a structured approach that incorporates the following key strategies:

1. Comprehensive Risk Assessment

The foundation of proactive risk management is a thorough risk assessment. This process involves identifying potential risks, evaluating their likelihood and impact, and prioritising them based on their significance. A comprehensive risk assessment helps organisations focus their resources on the most critical threats, ensuring that they are well-prepared to handle them. For guidance on best practices in risk assessment, consider following the ISO 31000 Risk Management framework, which provides principles and guidelines for managing risk effectively.

2. Developing a Risk Mitigation Plan

Once risks are identified, the next step is to develop a risk mitigation plan. This plan should outline specific actions that will be taken to prevent or minimise the impact of each risk. Key components of a risk mitigation plan include:

- Preventive Measures: Actions taken to reduce the likelihood of risks occurring, such as implementing safety protocols or conducting regular audits.

- Contingency Planning: Preparing for potential scenarios where risks may materialise, ensuring that the organisation can respond swiftly and effectively.

- Resource Allocation: Ensuring that the necessary resources, including personnel, technology, and finances, are available to implement the mitigation plan

3. Continuous Monitoring and Adaptation

Proactive risk management is not a one-time effort; it requires continuous monitoring of the risk environment and the effectiveness of mitigation strategies. Ongoing monitoring allows organisations to detect new threats and adjust their risk management plans accordingly. This dynamic approach ensures that the organisation remains agile and responsive to changing conditions.

4. Stakeholder Engagement and Communication

Engaging stakeholders in the risk management process is essential for success. This includes not only internal teams but also external partners, suppliers, and customers. Open communication about potential risks and mitigation strategies fosters a culture of risk awareness and collaboration, which is vital for effective risk management.

5. Leveraging Technology for Risk Management

Technology plays a crucial role in enhancing proactive risk management. Advanced analytics, artificial intelligence, and machine learning tools can help organisations predict and assess risks more accurately. These technologies enable real-time monitoring, data-driven decision-making, and more effective implementation of risk mitigation strategies..

Best Practices in Proactive Risk Management

To maximise the effectiveness of proactive risk management, organisations should follow these best practices:

Risk Culture Integration

Building a strong risk culture within the organisation is key to ensuring that proactive risk management is embraced at all levels. This involves educating employees about the importance of risk management, encouraging them to identify and report potential risks, and integrating risk considerations into everyday decision-making.

Scenario Planning and Stress Testing

Scenario planning and stress testing are valuable tools for understanding the potential impact of risks under different conditions. By simulating various scenarios, organisations can evaluate the effectiveness of their risk management strategies and make necessary adjustments to improve resilience.

Regular Review and Update of Risk Management Plans

The risk environment is constantly evolving, so it is important to regularly review and update risk management plans. This ensures that the organisation’s risk strategies remain relevant and effective in the face of new challenges.

Collaborative Risk Management

Collaboration between departments, as well as with external partners, enhances the effectiveness of proactive risk management. Sharing information, resources, and best practices helps organisations build a more comprehensive and robust risk management framework.

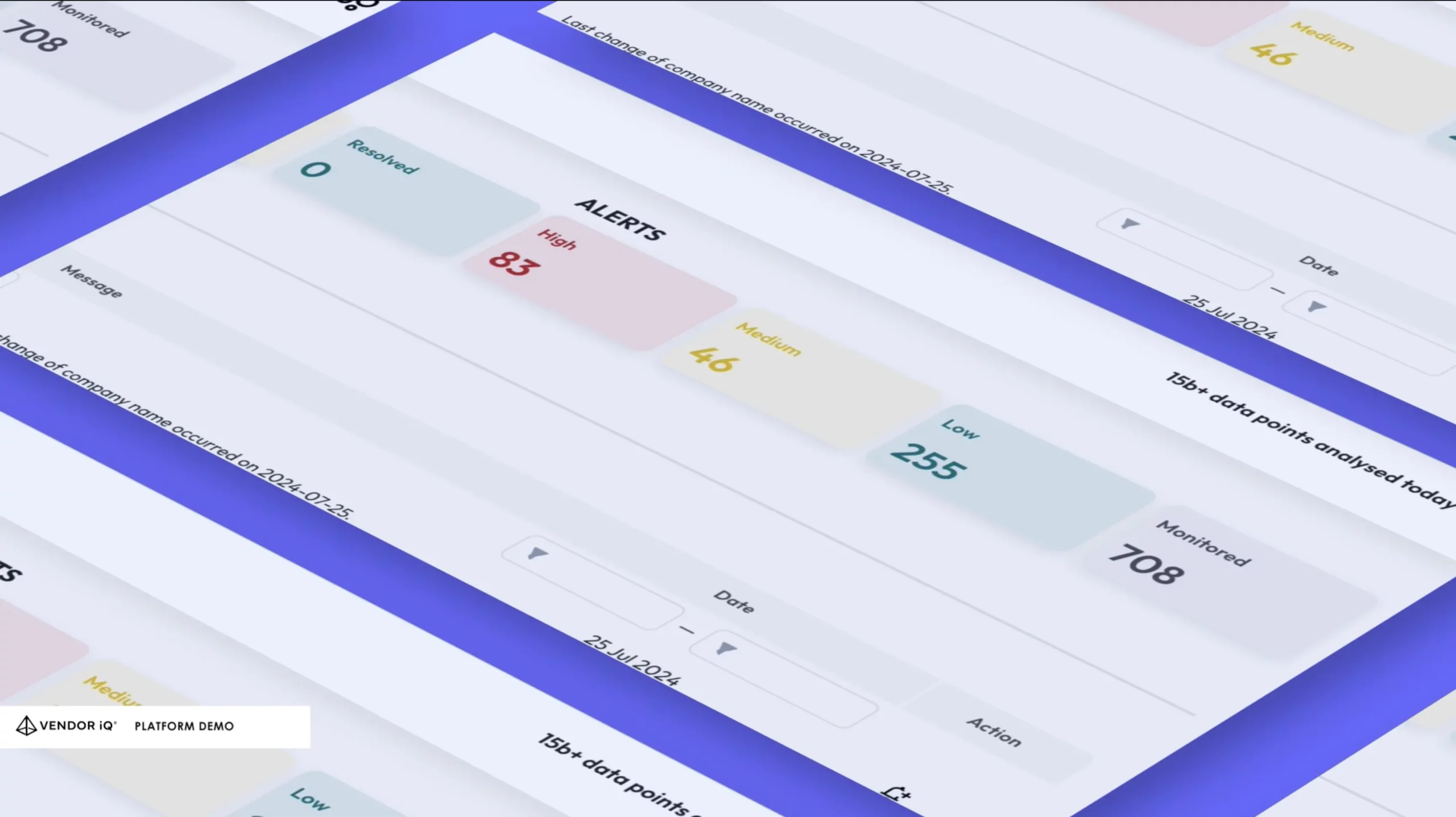

The Role of VENDOR iQ in Proactive Risk Management

For proactive risk management in financial services organisations, VENDOR iQ offers a powerful platform designed to support comprehensive risk management strategies. By providing advanced tools for risk assessment, continuous monitoring, and stakeholder engagement, VENDOR iQ helps organisations stay ahead of potential threats and maintain operational resilience.

With VENDOR iQ, companies can ensure that their proactive risk management practices are not only effective but also aligned with their broader business goals.

Proactive risk management is not just about avoiding problems—it’s about positioning your institution for long-term success. With VENDOR iQ, financial institutions can effectively anticipate and mitigate risks, ensuring operational resilience and compliance. As the financial landscape continues to evolve, those who embrace proactive risk management will be best positioned to thrive.

Are you ready to elevate your risk management strategy? Discover how VENDOR iQ can empower your institution with the tools and insights needed to manage risks proactively and ensure your operations remain resilient.