Proactive Risk Management in Financial Services: The VENDOR iQ Advantage

In the fast-paced world of financial services, managing risks is not just about responding to issues as they arise—it’s about anticipating them before they become critical. Proactive risk management is the key to safeguarding your institution’s operations, reputation, and compliance status. At VENDOR iQ, we understand the importance of staying ahead of potential risks and have developed a robust platform to support financial institutions in this crucial endeavour.

What is Proactive Risk Management?

Proactive risk management involves identifying, assessing, and mitigating risks before they can impact your business. Unlike reactive strategies that address problems after they occur, proactive risk management focuses on foreseeing potential issues and implementing measures to prevent them. This approach is particularly vital in financial services, where the stakes are high, and the consequences of unmanaged risks can be severe.

Why Proactive Risk Management Matters in Financial Services

Financial institutions operate in an environment filled with various risks, including market volatility, cyber threats, regulatory changes, and third-party dependencies. The challenge lies in not only identifying these risks but also in managing them proactively to minimise their impact. VENDOR iQ provides the tools necessary for institutions to adopt a proactive stance, ensuring they are always prepared for whatever challenges may arise.

1. Identifying Risks Early

The first step in proactive risk management is early identification. By using advanced analytics and monitoring tools, VENDOR iQ helps financial institutions detect potential risks in real-time. Whether it’s a shift in market conditions or an emerging cyber threat, early detection allows for timely intervention, reducing the likelihood of a risk escalating into a full-blown crisis. For example, understanding frameworks like the NIST Cybersecurity Framework can aid in identifying cybersecurity risks early.

2. Continuous Monitoring and Analysis

Proactive risk management requires continuous monitoring and analysis of both internal and external factors that could pose a threat. VENDOR iQ’s platform is designed to provide ongoing surveillance of key risk indicators, offering insights that are crucial for making informed decisions. Tools like Tableau and Power BI enhance this process by providing powerful data visualisation capabilities that help in interpreting complex data sets.

3. Mitigating Risks Before They Escalate

Once potential risks are identified, the next step is to mitigate them effectively. VENDOR iQ empowers institutions with actionable insights that guide them in implementing risk mitigation strategies. This might involve adjusting operational processes, enhancing cybersecurity measures, or revising compliance protocols. Adhering to guidelines from regulatory bodies such as the Financial Conduct Authority (FCA) can be instrumental in these efforts.

4. Ensuring Compliance and Operational Resilience

Compliance with regulatory requirements is a cornerstone of risk management in financial services. VENDOR iQ assists institutions in maintaining compliance by providing real-time insights into their operations and identifying areas where they may be vulnerable to regulatory breaches. Ensuring operational resilience through proactive risk management also means being prepared for unforeseen events, such as market disruptions or cyberattacks, which can be mitigated with the right strategies in place.

The VENDOR iQ Platform: Your Partner in Proactive Risk Management

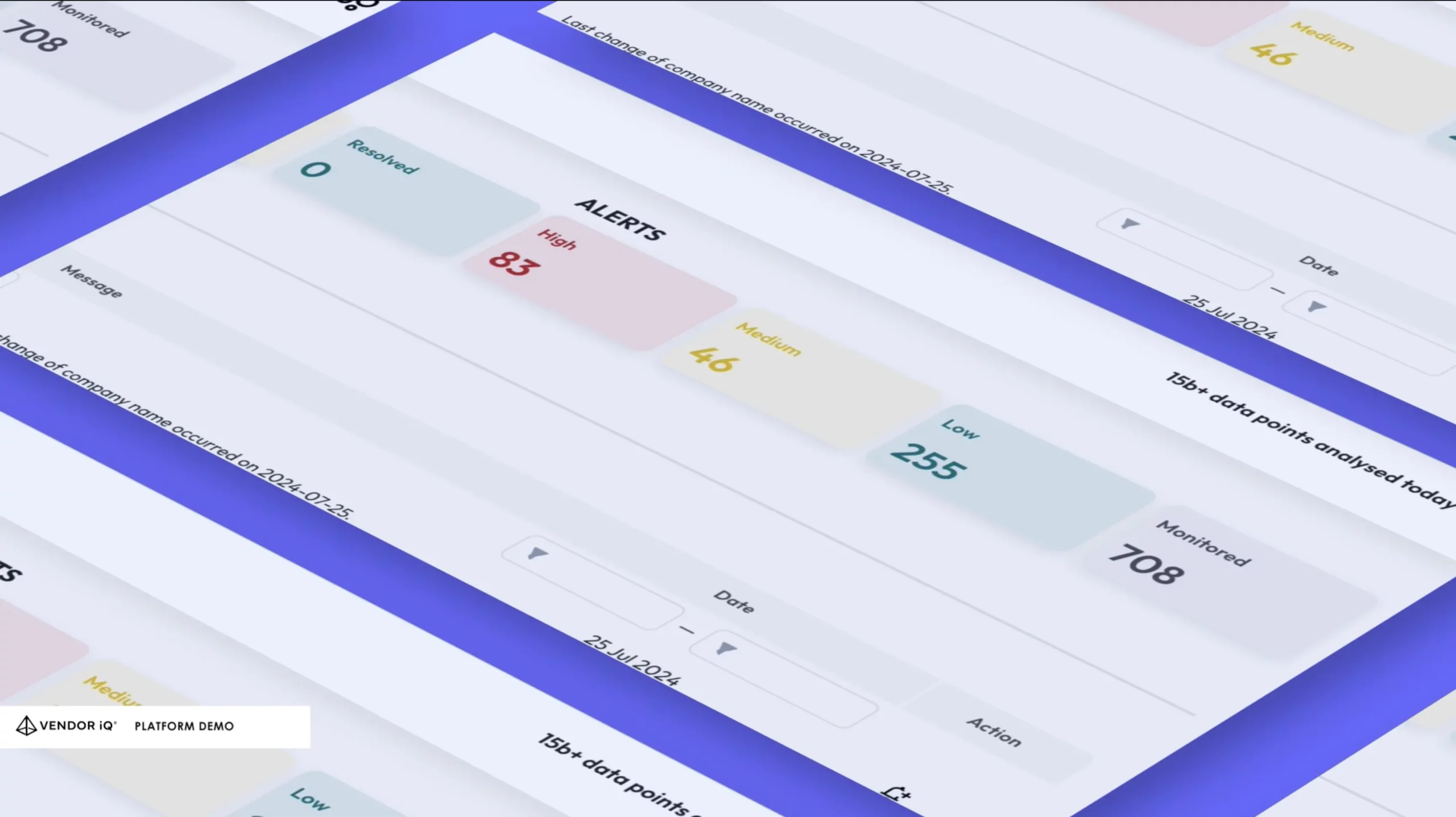

VENDOR iQ’s platform is designed to support financial institutions in all aspects of proactive risk management. By providing real-time data, comprehensive analytics, and customisable dashboards, our platform helps institutions stay ahead of potential risks and ensures they can respond swiftly and effectively when necessary.

- Real-Time Risk Monitoring: Stay informed with instant updates on potential risks and emerging threats.

- Advanced Analytics: Use powerful tools to analyse risk factors and develop strategies to mitigate them.

- Customisable Dashboards: Tailor the platform to meet your institution’s specific risk management needs, ensuring that critical data is always accessible.

Implementing Proactive Risk Management with VENDOR iQ

Adopting a proactive approach to risk management requires more than just technology; it requires a cultural shift within the organisation. VENDOR iQ not only provides the technological tools needed for proactive risk management but also supports institutions in developing a culture that prioritises foresight and preparedness.

Proactive risk management is not just about avoiding problems—it’s about positioning your institution for long-term success. With VENDOR iQ, financial institutions can effectively anticipate and mitigate risks, ensuring operational resilience and compliance. As the financial landscape continues to evolve, those who embrace proactive risk management will be best positioned to thrive.

Are you ready to elevate your risk management strategy? Discover how VENDOR iQ can empower your institution with the tools and insights needed to manage risks proactively and ensure your operations remain resilient.