Mastering Vendor Management in Financial Services: A Strategic Guide by VENDOR iQ

In the competitive and highly regulated world of financial services, effective vendor management is crucial. It’s not just about managing relationships with third-party suppliers; it’s about driving operational efficiency, ensuring compliance, mitigating risks, and maximising the value derived from these partnerships. At VENDOR iQ, we specialise in helping financial institutions streamline their vendor management processes, ensuring they are well-positioned to meet their strategic goals.

What is Vendor Management?

Vendor management is the process of overseeing and optimising relationships with third-party vendors. It involves everything from vendor selection and contract negotiation to performance monitoring and risk mitigation. Effective vendor management ensures that financial institutions not only meet their regulatory obligations but also extract maximum value from their vendor relationships.

Vendor Selection and Onboarding

The foundation of effective vendor management lies in selecting the right vendors. This process involves thorough research, due diligence, and evaluation of potential vendors based on factors such as compliance with regulatory standards, financial stability, and the ability to meet specific business needs. Once selected, vendors must be properly onboarded, with clear expectations set through well-defined contracts and service level agreements (SLAs).

Performance Monitoring and Evaluation

Continuous performance monitoring is vital to ensure that vendors meet their contractual obligations and contribute to the organisation’s success. VENDOR iQ’s platform provides real-time insights into vendor performance, allowing financial institutions to assess vendor contributions against predefined KPIs and SLAs. This ongoing evaluation helps identify areas for improvement and informs decisions on contract renewals or terminations.

Risk Management in Vendor Relationships

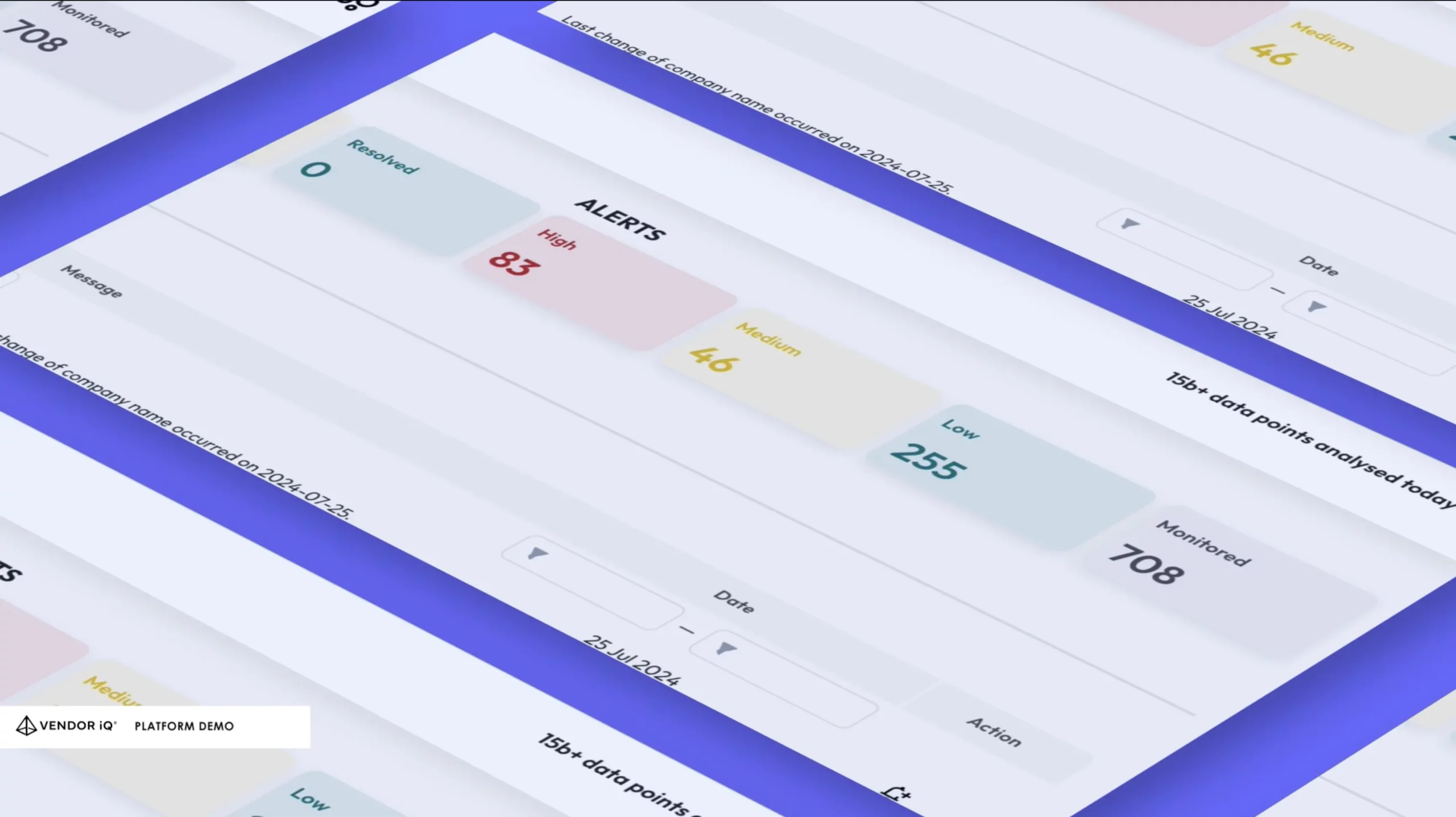

Managing risks associated with third-party vendors is a key component of vendor management. Financial institutions must proactively identify, assess, and mitigate risks such as financial instability, data security breaches, and compliance failures. VENDOR iQ’s platform is equipped with advanced risk management tools that help institutions monitor vendor-related risks in real-time, ensuring that any potential issues are addressed before they escalate.

Ensuring Compliance and Regulatory Adherence

In the financial services sector, compliance is non-negotiable. Vendor management processes must ensure that all third-party vendors adhere to relevant regulatory requirements, such as those outlined by the Financial Conduct Authority (FCA). VENDOR iQ helps institutions maintain compliance by providing a centralised platform for tracking vendor adherence to regulatory standards, conducting regular audits, and managing documentation.

Maximising Value from Vendor Relationships

Beyond compliance and risk management, effective vendor management is about maximising the value derived from vendor relationships. This involves negotiating favourable contract terms, fostering long-term partnerships, and leveraging vendor expertise to achieve business goals. By adopting a strategic approach to vendor management, financial institutions can enhance their operational efficiency, reduce costs, and improve overall performance.

Challenges in Traditional Vendor Management

Traditional approaches to vendor management, often reliant on manual processes and fragmented systems, present several challenges. These include:

- Lack of Centralised Visibility: Without a centralised system, critical vendor information is scattered across various documents and systems, making it difficult to track performance and compliance.

- Manual Processes: Relying on manual processes for vendor management can lead to inefficiencies, data inaccuracies, and missed deadlines, all of which can compromise regulatory compliance.

- Limited Scalability: Traditional methods are often not scalable, making it challenging to adapt to evolving regulatory requirements and market dynamics.

The VENDOR iQ Solution

VENDOR iQ offers a comprehensive vendor management solution designed to address these challenges. Our platform centralises all vendor-related information, automates key processes, and provides real-time insights into vendor performance and risks. With VENDOR iQ, financial institutions can streamline their vendor management processes, ensuring they remain compliant, efficient, and competitive.

- Centralised Vendor Data: Access all vendor information in one place, ensuring full visibility and control over vendor relationships.

- Automated Compliance Tracking: Automate the monitoring of vendor compliance with regulatory standards, reducing the risk of non-compliance.

- Real-Time Risk Monitoring: Stay ahead of potential risks with real-time alerts and risk assessments, allowing for proactive management of vendor-related issues.

Implementing a Strategic Vendor Management Approach

Implementing an effective vendor management strategy requires more than just technology; it requires a commitment to continuous improvement and strategic planning. VENDOR iQ not only provides the tools needed for effective vendor management but also supports financial institutions in developing a culture of excellence in their vendor relationships.

For those looking to enhance their vendor management capabilities, educational resources such as Coursera’s Procurement and Vendor Management Courses can provide valuable insights into best practices and emerging trends.

By leveraging VENDOR iQ’s platform, financial institutions can transform their vendor management processes, ensuring they are well-equipped to navigate the complexities of the financial services landscape. Whether you are looking to improve compliance, reduce risks, or maximise value, VENDOR iQ has the solutions you need to succeed.

Are you ready to take your vendor management strategy to the next level? Discover how VENDOR iQ can help you optimise your vendor relationships and drive business success.