Vendor Management: The Cornerstone of Operational Efficiency in Financial Services

In the highly regulated world of financial services, managing vendor relationships effectively is crucial for maintaining operational efficiency, ensuring compliance, and mitigating risks. With the increasing complexity of supply chains and the growing reliance on third-party providers, a robust vendor management strategy is more important than ever.

The Importance of Vendor Management

Vendor management involves overseeing and coordinating the entire lifecycle of vendor relationships, from selection and contracting to performance monitoring and offboarding. This process ensures that financial institutions derive maximum value from their vendors while minimising risks associated with third-party relationships.

A well-structured vendor management strategy can help financial institutions:

- Enhance Operational Efficiency: By streamlining processes and improving communication with vendors, financial institutions can reduce costs and increase productivity.

- Ensure Compliance: Regulatory bodies require financial institutions to maintain stringent oversight of their vendors to ensure compliance with industry standards and regulations.

- Mitigate Risks: Proactive vendor management helps identify potential risks early, allowing institutions to address issues before they escalate.

Key Components of an Effective Vendor Management Strategy

Vendor Selection and Onboarding

- Thorough Due Diligence: Conduct comprehensive background checks and assessments of potential vendors to ensure they meet your institution’s standards for security, compliance, and performance.

- Contractual Clarity: Clearly define the terms of the vendor relationship, including performance expectations, compliance requirements, and risk management obligations.

Performance Monitoring

- Regular Reviews: Establish a schedule for regular performance reviews, ensuring that vendors are meeting their contractual obligations and delivering the expected value.

- KPI Tracking: Implement key performance indicators (KPIs) to monitor vendor performance in real-time, allowing for quick adjustments when needed.

Risk Management

- Risk Assessments: Continuously assess the risks associated with each vendor, considering factors such as data security, financial stability, and regulatory compliance.

- Risk Mitigation Plans: Develop and implement risk mitigation plans to address any potential vulnerabilities identified during risk assessments.

Vendor Relationship Management

- Open Communication: Foster strong, transparent communication channels with vendors to build trust and ensure alignment with your institution’s goals.

- Strategic Partnerships: Focus on building long-term strategic partnerships with key vendors to drive innovation and improve service delivery.

The Role of Technology in Vendor Management

Technology plays a critical role in modern vendor management, providing tools and platforms that streamline processes, improve data visibility, and enhance decision-making. Financial institutions can leverage vendor management software to automate key tasks such as onboarding, performance monitoring, and risk assessments.

One example of a comprehensive solution is the ISO 31000 standard, which offers guidelines for risk management applicable across various industries, including financial services. Adopting such standards can help institutions structure their vendor management processes more effectively, ensuring compliance and reducing risks.

Why Vendor Management Matters More Than Ever

In the current regulatory environment, financial institutions are under increasing pressure to demonstrate that they are effectively managing their third-party relationships. Failure to do so can result in severe penalties, not to mention damage to the institution’s reputation.

Proactive vendor management not only helps institutions avoid these pitfalls but also creates opportunities for strategic growth. By building strong, mutually beneficial relationships with vendors, financial institutions can enhance their operational efficiency, reduce costs, and stay ahead of the competition.

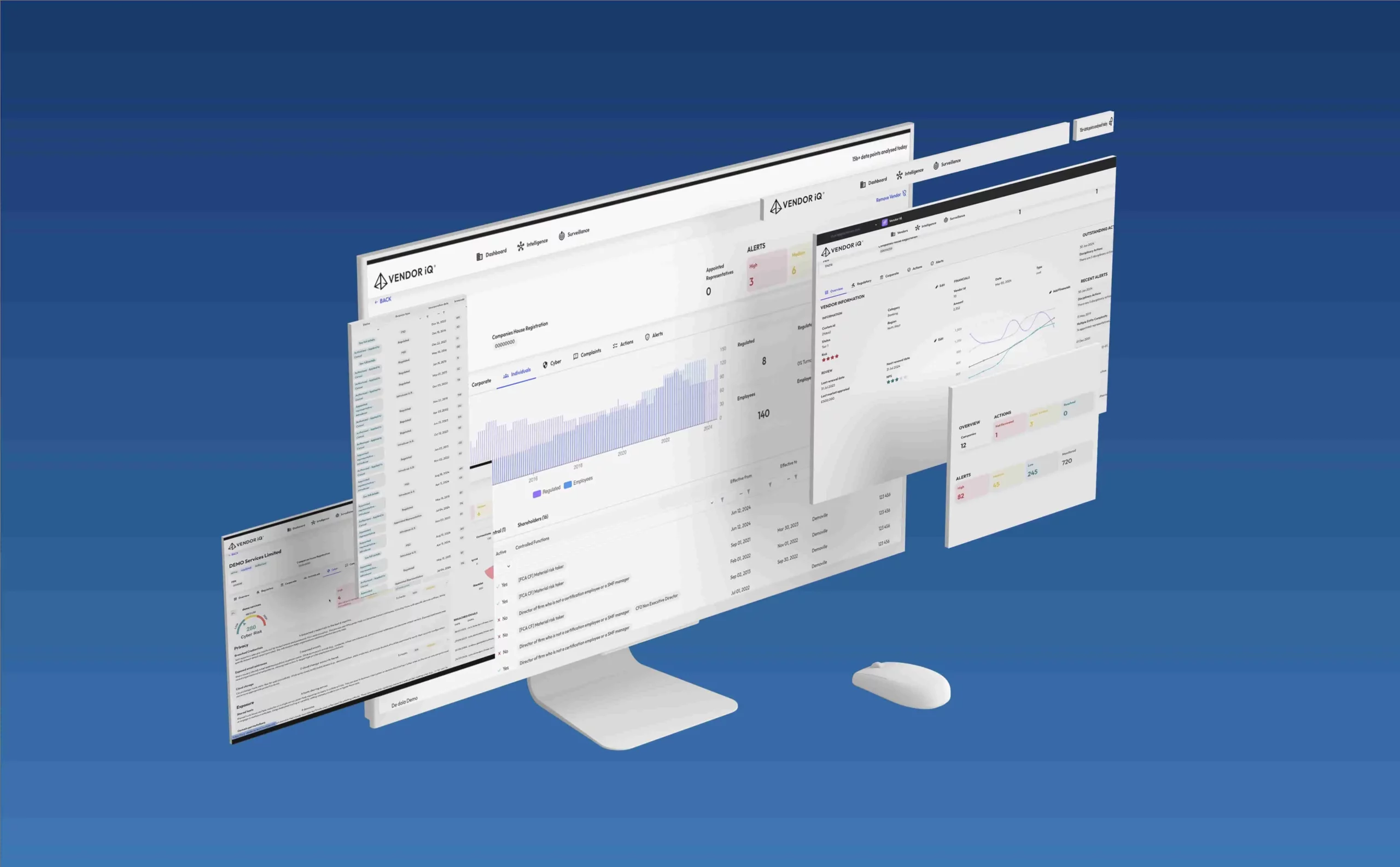

VENDOR iQ: Your Partner in Vendor Management

At VENDOR iQ, we understand the challenges financial institutions face in managing complex vendor relationships. Our data-driven platform provides real-time insights into vendor performance, helping you make informed decisions and mitigate risks. With VENDOR iQ, you can streamline your vendor management processes, ensuring compliance and enhancing operational efficiency.